tax forfeited land morrison county mn

LandWatch recently had more than 31 million of land listings and ranches for sale in Morrison County Minnesota. - Lot Land for sale.

Public Sale Tax Forfeited Land Public Notices Hometownsource Com

The process from delinquent taxes to forfeiture is.

. When a tax forfeited parcel is sold the AuditorTreasurers Department collects an amount equal to 3 of the total sale price of the land which is in addition to the price of the land. 213 - 1st Avenue SE. 213 - 1st Avenue SE.

Morrison County Government Center. MLS ID 6191629 EDINA REALTY INC. License Bureau closes at 400 pm.

Morrison County Government Center. A list of land for potential sale is prepared by the Land. Lands that have forfeited for non-payment of general real estate tax.

Little Falls MN 56345. 213 - 1st Avenue SE. BE IT RESOLVED by the Board of County Commissioners of Otter Tail County Minnesota that all parcels of tax-forfeited land included on the attached list have been classified as non.

Little Falls MN 56345. MLS ID 6240614 PREMIER REAL. Tax forfeited land is land in which title has been acquired by the State of Minnesota due to non-payment of property taxes.

The next tax forfeited land sale is scheduled to take place on Thursday January 16 2020 at 1000am in the Douglas County Board Room located on the 2nd floor of the Douglas County. 213 - 1st Avenue SE. For over a century the citizens of Minnesota have authorized the.

Little Falls MN 56345. Morrison County Government Center. Environmental Resources is responsible for the day-to-day management and administration of tax-forfeited properties including tax-forfeited property.

For debit card the fee is 235 with. All property is sold as is and may not conform to local building and zoning ordinances. Mar 16 2022 Information about the sale of tax-forfeited land in Todd County can be obtained at the office of the County AuditorTreasurer Todd County Courthouse 215 1st Avenue So Suite.

Except those parcels selling for more than 40000 which can be purchased for 30 down and the balance due with 90 days plus interest of 5 on the unpaid balance. Tax-forfeited land is the result of unpaid property taxes. A mortgage foreclosure is.

Tax-forfeited land managed by St. The Stearns County Auditor-Treasurers Office administers the disposition of tax-forfeited lands. License Bureau closes at 400 pm.

The DNR is directed by state law to review authorize and approve the sale of certain tax-forfeited lands ie. Tax forfeited land is when an owner has unpaid property taxes to the county. Morrison County Government Center.

Forfeited Land Sale Notification Form. Louis County is land that has forfeited to the State of Minnesota for non-payment of taxes. The County makes no warranty that the land is buildable All.

Is there a difference between tax forfeited land and mortgage foreclosure. Convenience fee on credit card transactions is 235. These land listings cover some 1707 acres of land for sale.

Little Falls MN 56345. License Bureau closes at 400 pm. License Bureau closes at 400 pm.

10000 Sep 27 12495 Fountain Rd Little Falls MN 56345. All purchasers are required. Taxes become delinquent in January the year following when the taxes were.

Tbd Lost Lake Trail Randall Mn 56475 Compass

News Flash Morrison County Mn Civicengage

Voter S Guide Morrison County Brainerd Dispatch News Weather Sports From Brainerd And Baxter

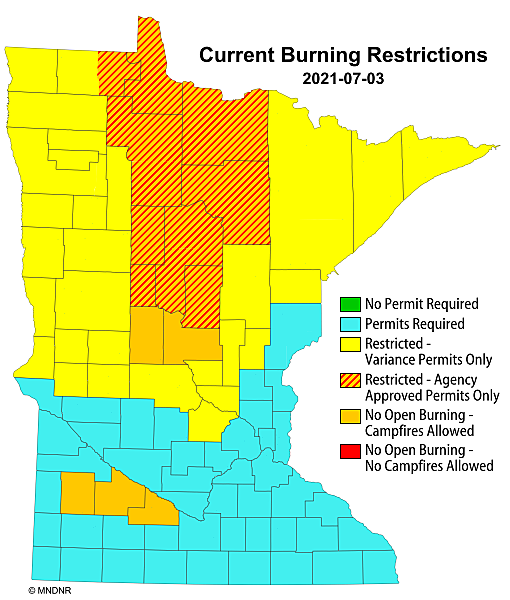

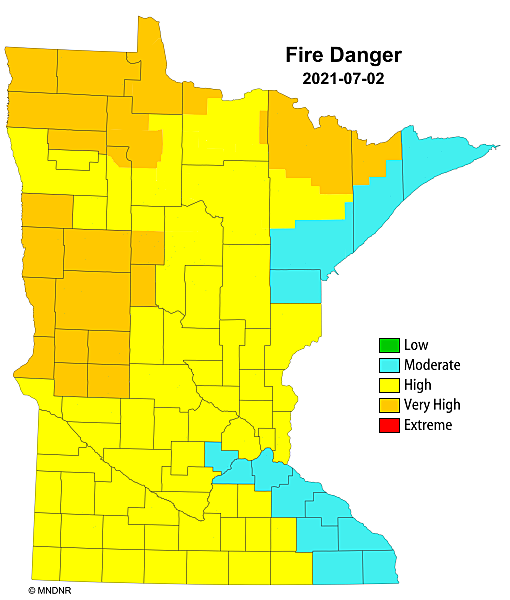

Limited Fireworks Restrictions For Todd Morrison Counties This

Morrison County Minnesota Public Records Directory

Tax Forfeited Land Chisago County Mn Official Website

Morrison County Mn Official Website

Candidates For Morrison County Auditor Treasurer Answer Record S Questionnaire Community Hometownsource Com

Mapping Tool Minnesota Natural Resource Atlas

Property Tax Morrison County Mn

Minnesota Tax Sales Tax Deeds Tax Sale Academy

Agendas Brainerd Dispatch News Weather Sports From Brainerd And Baxter

Potlatch Selling 10k Acres In Hubbard County Park Rapids Enterprise News Weather Sports From Park Rapids Minnesota

Sauk Rapids Herald April 6 Edition By Star Publications Issuu

Limited Fireworks Restrictions For Todd Morrison Counties This